Regulation

AxiomSL Launches Material Nonpublic Information Cloud Solution

AxiomSL launched its new cloud solution for material nonpublic information for regulatory and risk reporting to make it easier for clients to access information.

CFTC Stresses Exchange Role in Crypto Derivatives Guidance

Agency will step in and act where required, but the lion’s share of responsibility falls to venues.

Experts Warn on Buying into Regtech Hype

Long-term views and collaboration, rather than flashy tech, is the key to a successful program of compliance, panelists at BST Europe say.

Axioma, Abel Noser Partner for Liquidity Reporting Solution

The solution will be integrated into Axioma's end-to-end regulatory reporting platform.

Wavelength Podcast Episode 121: An Examination of CQRS; Coinbase’s Institutional Play

Linedata's Dave Remy and Chris Condron discuss all things CQRS and James Rundle goes over some of the big news breaking in the crypto space.

Where There’s a Will, There’s a Way

With less than a month to go until the SGX lists its new India derivative products, anything can happen. All eyes are on India’s regulator, Sebi, as well as the country’s three exchanges, to see what action—if any at all—they will take.

Wavelength Podcast Episode 120: CCP Non-Default Losses

James and Anthony look at the main issues around CCP non-default losses, who should be responsible for these funds, and where this is all heading.

How is the Industry Faring in a Post‑Mifid II World?

The revised Markets in Financial Information Directive (Mifid II) went into effect at the start of 2018 and, as with any significant regulation go-live, there were some hiccups. Three months later, there are still gaps that need to be filled –…

Getting Ready for CAT

While the consolidated audit trail (CAT) may have missed its initial November go-live date, the project is far from over. Broker-dealers will still need to report to the system when compliance deadlines are finalized, and it may be wise to begin…

Ayasdi Partners with Navigant to Grow its AML Offering

The collaboration will be geared toward developing services that employ both AI and ML techniques to spot fraud, while helping banks with their development roadmaps.

CFTC's Budget Cut Constrains Crypto Oversight, Market Resiliency Activities

A higher budget, on the other hand, could bring in extra staff to monitor clearinghouses and fraud manipulation in crypto markets, says CFTC commissioner Quintenz.

Monetary Authority of Singapore Releases Timeline, Finalized Forms for Revised Reporting Notices

Financial institutions in Singapore have 24 months to be fully compliant with the Monetary Authority of Singapore’s revised notices 610 and 1003 for collecting trade data—though details of some asset classes will be released later, as the industry…

Global Fragmentation Looms in FRTB Data Pooling Stand-Off

The upcoming FRTB market risk framework allows financial firms to take different approaches to non-modelable risk factors: either capitalize risk factors that lack observable pricing in-house, or use a vendor-run data pooling utility. But, as Dan…

Bond Trading Takes Steps to Resolve Voice and Screen Conflict

With Mifid II's deadline in the rear-view mirror, Hamad Ali gives a "State of the Union" for the fixed-income market and electronic trading platforms.

Schroders Turns to Commcise for Mifid II Research

Platform gives greater transparency for compliance with unbundling requirements under European rules.

Mind the Governance Gap: Data Key to SEC Modernization Compliance

Good data governance plans will be key to compliance with new sweeping legislative changes from the SEC. But for those who haven’t established effective data governance practices—and even for many who have—the changes could prove a steep and arduous…

Wavelength Podcast Episode 118: CAT ‘State of the Union’, RTS 27 & 28 Concerns, The ‘Big Tech’ Dilemma

Anthony and James discuss some of the big stories to come out of TradeTech Europe and then three legal experts look at how the SEC has been quiet about the CAT.

In Broadsides and Brush Strokes, Traders Call for Lighter Regulatory Touch

Speakers and attendees at TradeTech Europe called, with varying degrees of subtlety, for a relaxation of regulatory reform.

Google Denies Rumored Plans to Enter Financial Markets

Tech giant has no immediate plans to enter the space outside of its role as a service provider, despite uneasy conference chatter.

Big Problems, Short Codes: A Potential Solution to GDPR's Info Privacy Challenges

Looking ahead to GDPR, ARMs and trading venues are developing ways to better protect the personal data they are required to collect, report and store under Mifid II, while investment firms tasked with providing personally identifiable information to the…

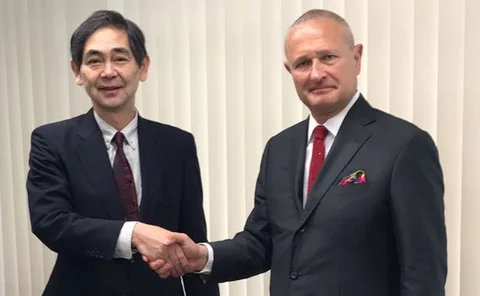

Encompass, Nikkei MM Ally for Japanese KYC Compliance

Users will have access to news and corporate data from Nikkei MM for KYC and AML compliance, and the ability to monitor their exposure to entities or individuals linked to the Yakuza.

Wary Brokers Sound Alarm on Mifid II's RTS 28

Brokers are concerned that reports on best execution, due in just a few days, may be too onerous to produce in full.

Exchange Execs Cast Doubt on Mifid II's Best-Ex Reports

Experts warn venue reports will be unreliable and effectively bereft of value for investors.

Regnosys to Expand Reach with Bank, Regulatory Implementations

In addition to its work with Isda, the fintech startup also has projects in the works with ING Bank and the FCA.