Reference data

Firms challenging Cusip file new lawsuit alleging antitrust violations, breach of contract

A broker-dealer and two investment managers have filed a new, joint complaint against the quartet of companies associated with management of the Cusip numbering system.

Market and reference data management: Challenges abound

The extent to which capital markets firms are able to accurately and transparently analyze their market and reference data spending, while simultaneously managing and optimizing their usage, is not an area that has always received a lot of attention, but…

APAC Buy-Side Firms Embrace Alt Data and the Cloud

This paper comprises three sections: respondents’ demographics, alternative data and the cloud.

MarketAxess completes migration of Deutsche Börse’s reg reporting businesses

The market operator has onboarded about 500 new clients and aims to create new revenue streams to ease the ongoing cost and margin pressures.

Europe could face settlement squeeze with T+1 proposals and CSDR fines

Move to shorten the settlement cycle in the US could have knock-on implications for other markets, as the EU grapples with a new penalty regime.

From pharma to finance: Cracking the DNA of data management

Enterprise data management has traditionally addressed any aspect of financial data across an organization. But as investment firms’ portfolios of enterprise data broadens in definition to include other types of non-financial data, EDM projects must also…

Federal court denies motion for early judgement on Cusip numbers’ copyrightability

A judge for the Southern District of New York has also ordered that two class-action suits brought against Cusip Global Services and its affiliates earlier this year be consolidated.

The World’s Fastest File System for Financial Services

Speed. Agility. Storage. In financial services, the need has never been greater.

High-Performance Storage for AI and ML

It’s a highly complex question with a deceptively simple answer: How do you win with artificial intelligence, machine learning, and high-performance, computing-based analytics? Speed.

Deploy a scalable distributed file system — rapidly, easily and affordably

Eliminate the complexity, cost and delays of configuring a distributed file system from multiple components and manufacturers. Hitachi Content Software for File lets you design and deploy a leading edge file system — now.

Top three fixed income venues confirm bid to deliver EU consolidated tape for bonds

Bloomberg, MarketAxess and Tradeweb will join forces to create an independent company and will submit a request for information in search for a third-party vendor to partner with.

This Week: Microsoft/CaixaBank, Bloomberg, Cboe/Morningstar & More

A summary of the latest financial technology news.

Broadridge’s Gokey eyes interop to connect back-office data for front-office needs

The vendor is leveraging its back office capabilities and platforms to integrate Itiviti, and bolster its LTX bond trading platform.

LSEG-MayStreet: From direct feeds revamp to reg tools, industry sources outline rationale for deal

The acquisition of the 10-year-old vendor will give the exchange group high-quality market data, low-latency direct feeds, and packet-capture capabilities, experts say.

In the world of financial data, context—not content—is the new king

For years, the mantra of the market data world has been ‘content is king.’ But with trading strategies now more dependent on being able to see the big picture, the value of context could quickly overtake the data itself.

People Moves: TP Icap, Nasdaq, CFTC, and more

A look at some of the key "people moves" from this week, including Mark Govoni (pictured), who joins TP Icap as the chief executive officer of its agency execution division.

Plaintiffs in Cusips lawsuit argue the codes aren’t copyrightable

Firms file “aggressive” motion to have legal case resolved early, saying Cusip’s operators and owners have no basis to charge for the codes.

Waters Wrap: Snowflake’s cloud plans and what they mean for the interop movement

Upstart Snowflake hopes to be the global data network that brings true interoperability between data and trading platforms across the capital markets. Anthony says it’s an audacious plan, but one worth watching.

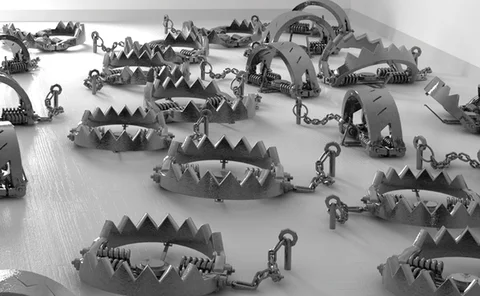

New datasets illuminate risky ‘pledged securities’ for investment analysis, due diligence

Until now, information around this opaque type of dataset has been hard to find, though it’s becoming increasingly important to financial analysts.

Bloomberg relaunches corporate actions platform

As a major player exits the corporate actions data vendor arena, Bloomberg is continuing to enhance its data offering while the market braces for a shake-up.

This Week: Six/Sustainalytics, Nice Actimize, SmartStream, and more

A summary of the latest financial technology news.

Goldman Sachs, DTCC execs dissect implications of SEC’s ‘ambitious’ settlement timeline

Conflicting time zones, potential re-papering, and weak standards are just some of the hurdles that must be overcome to move trade settlement times to T+1 or even to T+0—all potentially before Q1 2024.

This Week: Bloomberg; Charles River, DTCC, SmartStream & More

A summary of the latest financial technology news.

Second class-action lawsuit targets Cusip’s ‘monopoly’ on identifiers

Days after a first class-action suit took aim at Cusip, S&P Global, the American Bankers Association, and FactSet, another plaintiff has filed a complaint alleging that the quartet of companies violated the Sherman Antitrust Act, as well as certain…