Infrastructure

FRTB forces banks to rethink entire data management infrastructure

Data mapping and getting historical time series data are among the challenges banks face in conducting calculations necessary for FRTB. But they have help.

Google urges regulators, market participants to clarify risk guidance for AI models

A new whitepaper from Google finds that existing guidance on the use of AI and ML models for risk management is a start, but leaves room for improvement.

Hidden danger: As AI permeates finance, cybersecurity moves to the forefront

Open-source wrappers like MLflow, though useful and popular, highlight the risks hidden beneath these models.

What does it take to put a database in the cloud?

There are several ways to migrate an old legacy system to the cloud, but there's always a trade-off.

Coming to America: Foreign agents seek to subvert domestic tech incumbents

Vendor consolidation has given more to power to those who already hold the most power in the US. Can overseas providers who’ve already succeeded in smaller markets bring back competition?

Waters Wrap: Numerix, Fincad and the new world of M&A

Anthony says Numerix’s acquisition of Fincad is indicative of where technology development in the capital markets is heading.

Data management: Light at the end of the tunnel?

Data management issues have always presented challenges for the financial services industry. Here, DTCC explores why, with the right technologies, disciplines and structures in place, there is now reason for optimism.

Crypto custody faces regulatory death-roll

New measures to safeguard digital assets threaten to squeeze the life out of custody business, insiders fear

Pay now or pay later: Regtechs make play to spare banks steep fines

After a record year of fines issued by the SEC, financial services firms are rushing to implement regtech solutions that can help mitigate their financial exposures.

Winners and losers from the post-trade tech revolution

As the pace of tech evolution increases, Christian Sjoberg says firms that aren’t investing in new technologies to solve old post-trade problems will be left behind.

Ion wasn’t deemed a ‘critical’ vendor by most clients

The software firm escaped heavy scrutiny ahead of its cyber attack, says a US Treasury official.

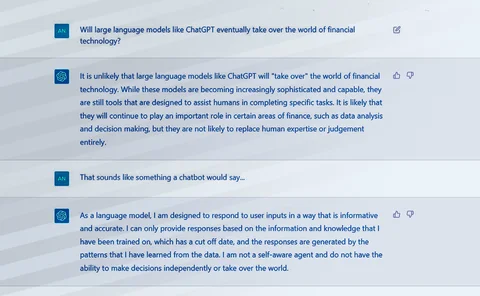

New chatbots reveal limitations of legacy API development

As large language models that underpin the likes of ChatGPT and Bard come to market, vendors and trading firms are starting to see the benefits—and challenges—that open APIs provide.

Ice exec rejects cloud for critical infrastructure

FIA Boca 2023: SVP Bland “can’t imagine” outsourcing critical infrastructure; DRW’s Wilson warns of concentration risk

DTCC’s blockchain for CDS trades finds no takers

Sources say the industry is not yet ready to fully adopt wide-scale implementations of distributed-ledger technologies.

Citadel Securities, Jane Street battle fixed-income connectivity challenges with MultiLynq buy-in

Increased electronification of fixed income markets requires more connectivity, which entails greater costs for firms to connect to a growing list of trading venues.

A rough race begins: Industry faces uphill transition to T+1 settlement

With T+1 compliance set to begin next May, firms will likely be burdened by reduced IT budgets, existing legacy systems and manual processes over the next 15 months. So, while faster settlement will help innovate the middle and back office, some argue…

MSCI’s multi-cloud strategy aims to provide a new window into investment data

The MSCI One platform already runs on Microsoft Azure, and MSCI is building a new investment data platform on Google Cloud to utilize the search giant's AI and NLP capabilities.

Smashing barriers: How shortwave frequencies are making trading firms faster

Improvements in shortwave radio frequencies could be a leap forward in the latency race. But given the costs and technical challenges, is it worth the investment?

Waters Wavelength Podcast: Digital asset custody infrastructure

Stephen Richardson, head of Apac and senior vice president of financial markets at Fireblocks, joins the podcast to chat about multi-signature and multiparty computation technology.

Buy-side compliance: Firms seek customizability and automation

This rapid read explores the types of compliance systems currently in place at buy-side firms, their efficacy, the need to improve automation levels, demand for customizability and the factors preventing buy-side firms replacing incumbent tools

Large language models: Another AI wave has come—what could it bring?

Since the release of ChatGPT, excitement and hype have been abundant across industries for this form of generative AI. For capital markets, the wave of innovation that could result may be a few years away but it’s worth paying attention to—and being…

Industry participants: ‘Digital Token Identifier’ aims to increase interop, usage

While some trading firms are welcoming the use of a new non-proprietary code for identifying digital tokens, the onus will be on local regulators to enforce its adoption.

BNY Mellon deploys new AI, cloud tools

The custodian bank has reduced payment processing times by as much as 80%, according to officials.

Data analytics dominate M&A agenda for exchanges in 2022

While there weren’t many headline-grabbing acquisitions in 2022, the year contained a handful of deals that point to expanding trends in the exchange technology industry.