Bank of America

In fake data, quants see a fix for backtesting

Traditionally quants have learnt to pick data apart. Soon they might spend more time making it up

This Week: Bloomberg, Ice, DTCC, & More

A summary of some of the past week's financial technology news.

Waters Wrap: Buzzwords and the hype machine (And editorial judgment)

Anthony previews some of the major trend topics that WatersTechnology will look to cover over the next eight months.

Waters Wrap: Would DLT really have prevented Archegos? (And thoughts on Itiviti)

While Christopher Giancarlo says distributed ledger technology could’ve helped prime brokers better monitor their risk exposures to Archegos Capital Management, Anthony (and others) are not so sure about that. He also looks at the Broadridge-Itiviti deal.

Waters Wrap: Big Tech takes control of cutting-edge encryption (And consortium flat circles)

In addition to growing their cloud presence in the capital markets, Big Tech companies are, unsurprisingly, taking the lead on encryption and security in the cloud. Anthony sees positives and negatives. He also looks at bank-led consortiums.

IBM lures banks’ critical workloads to financial cloud as ‘threat’ from big tech looms large

Having signed a trio of new banks to its financial services-specific cloud, the computing giant is betting on cutting-edge technologies like confidential computing to entice banks threatened by big tech firms.

Citi, other banks set to ink ‘Octopus’ deal for new multi-bank CLO platform

Sources say initiative is designed to fend off higher fees and disintermediation in case established multi-dealer platforms start trading CLOs.

Wavelength Podcast Ep. 223: IBM’s Likhit Wagle on Cloud Adoption

IBM’s general manager of global banking joins to talk about challenges and opportunities surrounding public cloud adoption and containerization.

ICE ‘Bonds’ Acquisitions into Fixed-Income Powerhouse

In this profile of the Intercontinental Exchange, Lynn Martin explains how the company’s ICE Data Services unit is creating a unified offering with fixed income data at its core, after a series of acquisitions that began with its purchase of IDC in 2015.

IBM Bets on Cloud & Containerization to Win Over Investment Banks

After its acquisitions of Red Hat and Promontory, IBM is looking to expand its footprint in the capital markets through containerization, as well as reg reporting in the cloud.

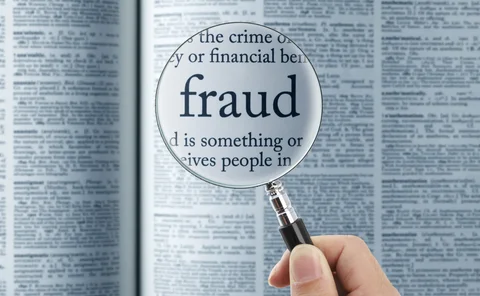

Waters Wrap: Is AML Tech Worth the Cost? (And Cloud Moves & More Blockchain)

Anthony wonders if AML platforms are being scrutinized enough by banks and regulators, then looks at Wells Fargo's tapping of HPR for its quant division and Northern Trust’s blockchain plans.

Wavelength Podcast Ep. 212: A Discussion About AI

An assortment of AI experts talk about various machine learning and NLP opportunities and challenges.

Waters Wrap: How Cloud, APIs, and Open Source Are Changing the World of Fintech (And Blockchain's ZTA Play)

Anthony looks at how the lines that have traditionally defined the world of "fintech" are blurring. Also, can blockchain help with ZTA's advancement?

Dealers Vie with IHS Markit to Electronify Bond Issuance

Competing platforms could split the market for new issuance in Europe and the US.

Waters Wrap: Banks Increasingly Lean on Vendors for 'Moonshots' (And Office Space Concerns & Symphony's KYC Play)

Anthony says that plenty of innovative projects are currently underway in the capital markets, it's just that banks are relying more heavily on vendors for those moonshots.

Investors Turn to Raw Data Over Ratings in ESG Alpha Hunt

Quants are using data on product returns and employee welfare to pick winners.

Covid‑19 and the Cash and Liquidity Management Challenges Facing the Capital Markets

The emergence of Covid-19 and the ensuing global pandemic has had a major impact on the capital markets—especially for banks and their cash and liquidity management practices. Banks need to know whether they have sufficient liquidity on an ongoing basis…

How Sarson Strover’s Outsourcing Policy Averted Virus Disruption

The newly fledged UK hedge fund has outsourced its portfolio management tech and operations to third parties, a move that has helped it through the coronavirus pandemic.

Covid-19 Tumult Tests AI Fund Returns

Some machine learning strategies have coped well, but others began to struggle as panic mounted.

People Moves: IBM Cloud, CoinShares & Seaborn Networks

This week's key people moves include former BofA CTO Howard Boville (pictured), who joins IBM Cloud as senior vice president.

AI Fraud Systems Frazzled by Covid-19

Seismic changes in customer behavior are seeing machine learning solutions throw out false positives.

In Expansion Beyond HFT, FPGAs Eye AI

After a decade of supercharging low-latency applications, Wei-Shen Wong explores how FPGAs are pushing into new areas of the capital markets, driven by interest in AI & ML.

Game On: Can the Video Game Industry Teach Banks Something About Visualization?

Capital markets firms are continually looking for new ways to package and visualize a rising tide of information. It turns out there’s another industry looking to handle the same challenge—the video game industry.