This Week: IHS Markit, SGX/HSBC, LedgerX, TNS, TraditionData and more

A summary of some of the past week's financial technology news.

IHS Markit, BondCliQ Collaborate to Deliver Corporate Bond Pricing Data in thinkFolio

IHS Markit has partnered with BondCliQ to embed US corporate bond pricing content within thinkFolio, its investment management platform. The collaboration will provide consolidated pre-trade quote data from 34 dealers, and post-trade TRACE data directly within thinkFolio’s screens.

BondCliQ’s consolidated quote display generates institutional pricing data for buy-side institutions and sell-side dealers. In combining with thinkFolio’s order and execution management workflows and connectivity, BondCliQ’s pre- and post-trade content is intended to provide pre-trade liquidity insight for securities of interest and aid in further demonstrating best execution to regulators and institutional clients.

Singapore Exchange, HSBC and Temasek Complete Digital Bond Pilot

Singapore Exchange (SGX), together with HSBC Singapore and Temasek, has completed its first digital bond issuance on SGX’s digital asset issuance, depository and servicing platform, replicating a S$400 million five-and-a-half-year public bond issue.

SGX used DAML, the smart contract language created by Digital Asset, to model the bond and its distributed workflows for issuance and asset servicing over the bond’s lifecycle. SGX’s solution uses smart contracts to capture the rights and obligations of parties involved in issuance and asset servicing, such as arrangers, depository agents, legal counsel, and custodians. The digital bond used HSBC’s on-chain payments solution.

Advantage Data Debuts Private Credit Analysis Tool

Boston-based fixed-income and derivatives pricing vendor Advantage Data has launched Private Credit Advantage, a pricing and analytics desktop for thousands of securities in the opaque private credit marketplace.

The new service includes pricing from more than 830 sources, yields and spreads on any benchmark, the ability to chart and overlay any combination of bonds, loans or indexes, a Historical New Issues Report, a comps function, bond calculator, and a Holdings Report, which allow users to combine securities with other instruments and asset classes to derive new insights.

T-Scape Debuts Voting Automation for Buy Side

London-based financial technology provider T-Scape is developing a new application to automate shareholder vote processes, in response to the regulatory requirements of the European Union’s Shareholder Rights Directive II. The application specifically addresses inefficiencies related to proxy voting, and will capture incoming data, alert users to new events, capture votes, and dispatch voting instructions, using a revised version of the ISO 20022 message format.

The new application, developed in partnership with an unnamed global investment manager, will be part of the vendor’s iActs corporate actions processing software suite.

CFTC Approves LedgerX to Clear Fully Collateralized Futures and Options

The Commodity Futures Trading Commission (CFTC) has announced it has approved an Amended Order of Registration for LedgerX, LLC, to clear additional products, subject to the terms and conditions specified in the order, as a derivatives clearing organization under the Commodity Exchange Act.

Under the amended order, LedgerX is authorized to provide clearing services for fully collateralized futures and options on futures in addition to the previously authorized swaps and will no longer be limited to clearing digital currency products.

LedgerX, a Delaware limited liability company located in New York City, is also registered with the CFTC as a designated contract market and swap execution facility.

TNS Expands Euronext Connection to Equities Market Data

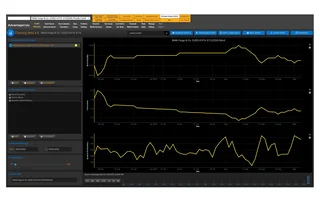

Transaction Network Services (TNS) is now offering ultra-low latency access to Euronext equities market data feeds through its TNSXpress Layer 1 solution.

The move augments TNS’s existing Euronext offering, which also includes access to Euronext derivatives and fixed income market data, as well as order routing. Originally available in the US, TNS is now rolling this technology out across Europe. The TNSXpress Layer 1 solution connects at Euronext’s colocation facility in Basildon, UK, and TNS can also offer its Managed Hosting solution at this location.

TNS’s network provides access to market data from over 60 venues and vendors.

TraditionDATA Announces Integration of Ameribor into Reference Rate Datasets

TraditionDATA, the data arm of Compagnie Financière Tradition, has integrated Ameribor, the interest rate benchmark created by the American Financial Exchange, as one of the US Dollar alternative reference rates (ARRs) in its product set.

TraditionDATA will publish spreads between Ameribor, Secured Overnight Financing Rate and the Effective Fed Funds Rate via its own data feeds, as well as through vendors including Refinitiv and Bloomberg.

The publication of these spreads will commence in early September, at a time when the global financial markets are focused on the retirement of the historic London Interbank Offered Rate and other global IBORs with new ARRs.

Apex, Calypso Partner to Provide Services to Ardent Financial

Apex Group has announced that it has been appointed to provide front-to-back office solutions to securities dealer Ardent Financial Limited, using Calypso Technology’s management and reporting platform. These services will coincide with Apex’s existing provision of custody services to Ardent.

Apex will provide decision support, analytics, and back office services to Ardent via the Calypso platform as part of the Apex360 solution.

IPC Launches Voice Trading Dictation Solution with GreenKey Technologies

Communications and networking solutions provider IPC has launched a managed voice trading dictation solution: Dictation-as-a-Service. Dictation-as-a-Service brings together GreenKey Technologies’ cloud-based speech recognition and natural language processing (NLP) engine with IPC’s Connexus Cloud financial ecosystem.

The service enables financial traders to “dictate” trade jargon via a dedicated IPC private wire, and consume the output transcribed in real time via GreenKey’s and IPC’s co-developed Blotter app. Traders can use Dictation as a Service for voice workflows, API integration with chat services, creating automated text records of voice trades, and trade reconstruction.

Deeper Analysis on WatersTechnology.com

Below are the five most-read stories on WatersTechnology.com from the past week.

European Commission Picks FactSet for Risk Data

Barclays Proposes New Taxonomy for Digital Tokens

Refinitiv Labs Leverages NLP to Track Covid-19 Company News

Snowflake Makes its Move (And Ref Data Headaches & Data-Sourcing-as-a-Service)

Dealers Vie with IHS Markit to Electronify Bond Issuance

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

The Waters Cooler: Tidings of comfort and joy

Christmas is almost upon us. Have you been naughty or nice?

FactSet launches conversational AI for increased productivity

FactSet is set to release a generative AI search agent across its platform in early 2025.

Waters Wavelength Ep. 295: Vision57’s Steve Grob

Steve Grob joins the podcast to discuss all things interoperability, AI, and the future of the OMS.

S&P debuts GenAI ‘Document Intelligence’ for Capital IQ

The new tool provides summaries of lengthy text-based documents such as filings and earnings transcripts and allows users to query the documents with a ChatGPT-style interface.

The Waters Cooler: Are times really a-changin?

New thinking around buy-build? Changing tides in after-hours trading? Trump is back? Lots to get to.

A tech revolution in an old-school industry: FX

FX is in a state of transition, as asset managers and financial firms explore modernizing their operating processes. But manual processes persist. MillTechFX’s Eric Huttman makes the case for doubling down on new technology and embracing automation to increase operational efficiency in FX.

Waters Wavelength Ep. 294: Grasshopper’s James Leong

James Leong, CEO of Grasshopper, a proprietary trading firm based in Singapore, joins to discuss market reforms.

The Waters Cooler: Big Tech, big fines, big tunes

Amazon stumbles on genAI, Google gets fined more money than ever, and Eliot weighs in on the best James Bond film debate.