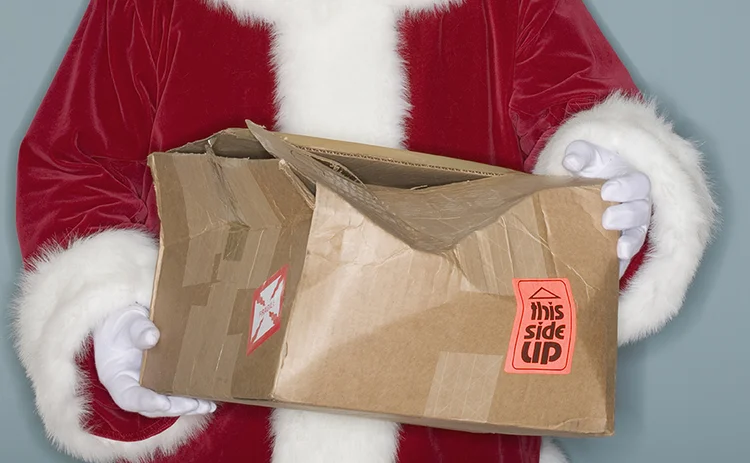

Esma’s LEI Xmas Extension: Last-Minute Gift or Lump of Coal?

Jamie Hyman talks with an LEI issuer, advocate and end-user about how Esma’s LEI grace period will impact operations during the first half of 2018.

More than 1 million Legal Entity Identifiers (LEIs) were registered in the lead-up to the January 3, 2018 deadline for compliance with Europe’s revised Markets in Financial Information Directive (Mifid II). Yet that number still falls far short of the estimated number of LEIs necessary as mandated under Mifid II’s rules, which require nearly every company, charity, trust, or fund to obtain an identifier.

As a result, five days before Christmas and two weeks before Mifid II’s deadline, pan

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Regulation

Nasdaq leads push to reform options regulatory fee

A proposed rule change would pare costs for traders, raise them for banks, and defund smaller venues.

The CAT declawed as Citadel’s case reaches end game

The SEC reduced the CAT’s capacity to collect information on investors, in a move that will have knock-on effects for its ongoing funding model case with Citadel.

Waters Wavelength Ep. 305: Cato Institute's Jennifer Schulp

Jennifer joins to discuss what regulatory priorities might look under Paul Atkin's SEC.

Examining Cboe’s lawsuit appealing SEC’s OEMS rule rejection

The Chicago-based exchange has sued the regulator in the Seventh Circuit Court of Appeals after the agency blocked a proposed rule that would change how Silexx is classified.

European exchange data prices surge, new study shows

The report analyzed market data prices and fee structures from 2017 to 2024 and found that fee schedules have increased exponentially. Several exchanges say the findings are misleading.

Regis-TR and the Emir Refit blame game

The reporting overhaul was been marred by problems at repositories, prompting calls to stagger future go-live dates.

FCA: Consolidated tape for UK equities won’t happen until 2028

At an event last week, the FCA proposed a new timeline for the CT, which received pushback from participants, according to sources.

Cusip Global Services wants to know, ‘What’s your damage?’

The evidence and discovery phase of the case against the identifier bureau is set to expire in March, bringing an anticipated jury trial one step closer.