Direxion turns to Two Sigma’s Venn for thematic ETFs

The firm is using the platform as a comparison tool as it evolves its fund offerings.

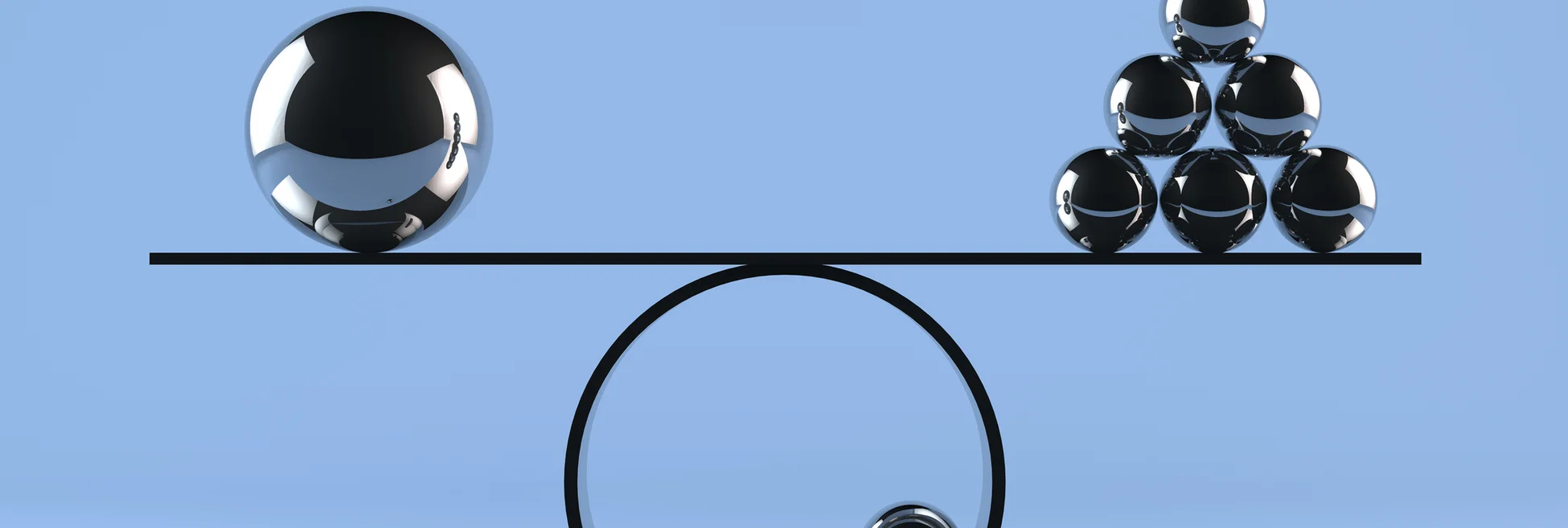

Direxion, an investment firm with $24.3 billion in assets under management that specializes in index-based products, is using Two Sigma’s investment and portfolio analytics platform, Venn, to help with thematic exchange-traded fund (ETF) offerings.

Historically, Direxion has targeted short-term tactical traders by offering inverse or leveraged ETFs, which take advantage of the downward price movement of an index. David Mazza, managing director and head of product at Direxion, says that around

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@waterstechnology.com or view our subscription options here: http://subscriptions.waterstechnology.com/subscribe

You are currently unable to print this content. Please contact info@waterstechnology.com to find out more.

You are currently unable to copy this content. Please contact info@waterstechnology.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@waterstechnology.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@waterstechnology.com

More on Emerging Technologies

LSEG rolls out AI-driven collaboration tool, preps Excel tie-in

Nej D’Jelal tells WatersTechnology that the rollout took longer than expected, but more is to come in 2025.

The Waters Cooler: ’Tis the Season!

Everyone is burned out and tired and wants to just chillax in the warm watching some Securities and Exchange Commission videos on YouTube. No? Just me?

It’s just semantics: The web standard that could replace the identifiers you love to hate

Data ontologists say that the IRI, a cousin of the humble URL, could put the various wars over identity resolution to bed—for good.

T. Rowe Price’s Tasitsiomi on the pitfalls of data and the allures of AI

The asset manager’s head of AI and investments data science gets candid on the hype around generative AI and data transparency.

As vulnerability patching gets overwhelming, it’s no-code’s time to shine

Waters Wrap: A large US bank is going all in on a no-code provider in an effort to move away from its Java stack. The bank’s CIO tells Anthony they expect more CIOs to follow this dev movement.

J&J debuts AI data contracts management tool

J&J’s new GARD service will use AI to help data pros query data contracts and license agreements.

An AI-first approach to model risk management

Firms must define their AI risk appetite before trying to manage or model it, says Christophe Rougeaux

Waters Wavelength Ep. 297: How to talk to the media

This week, Tony and Wei-Shen discuss the dos and don’ts for sources interacting with the media.